Chip Shortage Ravages Automotive Industry: Impact Unavoidable

Hello, my friends! Let’s talk about the unavoidable impact of chip shortage on Auto Industry! The content will include analysis and some solution from distributors.

CATALOG

1.Introduction

2.The impact of chip shortage on the automotive industry

3.Analysis of the reasons for the chip shortage in the automotive industry

4.Suggestion policy of crack automotive chip shortage to protect industry chain security

5.How can distributors help ease the auto chip shortage

6.Conclusion

1. Introduction

In recent years, the automobile industry has experienced a shortage of automobile semiconductor chips. The industry is facing the situation of not being able to manufacture cars due to the "lack of chips". Although the impact of the corona virus is also significant, is this the only factor? This blog examines the current state of the chip industry in the automotive semiconductor field.

2. The impact of chip shortage on the automotive industry

First of all, the pandemic will let us think about the influence of countries' embargo or quarantine measures on the automotive industry (supply chain factors in the automotive industry)

1) Decline in demand for automobiles (drop in sales)

2) Temporary closure of factories (decline in production)

3) Subsequent decrease in orders from OEMs to suppliers (decline in production of suppliers' products)

4) Decrease in orders from suppliers to semiconductor component manufacturers

3.Analysis of the reasons for the chip shortage in the automotive industry

Background: As an important application scenario for chips, automotive chips have also shown highly globalized characteristics during the transformation of the chip industry from a vertically integrated model (Integrated Design and Manufacture (IDM)) to a vertical division of labor model (e.g., IP-core companies, fabless design companies, wafer foundry companies, and professional packaging and testing companies). The main suppliers of automobiles, such as Infineon, STMicroelectronics, NXP, etc., to the relatively low value-added links in the layout of packaging, testing concentrated in labor-intensive areas, while the manufacturing link to the professional foundry foundry, extremely fine global division of labor in the face of external shocks there is a great deal of instability. Since 2020, automotive chips have seen unprecedented shortages, especially micro-control unit (MCU), system-on-chip (SoC) and other extreme shortages, the manufacturing link is the automotive chip supply shortage "blocking point".

From the end of 2020, Ford, General Motors, Volkswagen, BMW, Fiat Chrysler, Honda, Toyota, Nissan, Volvo, Hyundai, Kia and other automobile manufacturers one after another due to the lack of supply of chips to reduce production, short-term shutdown or delayed delivery, the domestic automobile manufacturers, such as the Azure, announced that the production cuts, and even some of the automobile enterprises to launch the "core reduction version! "A large number of automobile enterprises have reflected in undisclosed channels that the price of chips has "skyrocketed" and "a core is hard to find". The shortage of automotive chips is the result of multiple factors such as changes in geopolitical patterns and external shocks to the market supply and demand imbalance, adjustments in the automotive industry's operating model, the uniqueness of the automotive chip industry itself, and changes in the industry's laws and regulations, and other multiple factors superimposed on the fermentation.

The industry has regained its manufacturing pace, but potential disruptions in chip supply remain, and production momentum disruption has pushed a 100-million-unit year into the next decade.

The impact of the COVID-19 pandemic on the availability of semiconductor chips took a drastic toll on all facets of the automotive industry, and in turn the global economy. But in mid-2023, the worst of the fallout seems to have settled, and the auto industry has found a new normal. In short, the dearth of supply of semiconductor chips that hobbled vehicle production for most of 2021 and 2022 has faded into the background - - with some exceptions一according to recent analysis by S&P Global Mobility. S&P Global Mobility estimates that in 2021 more than 9.5 million units of global light-vehicle production was lost as a direct result of a lack of necessary semiconductors, with the third quarter of 2021 experiencing the largest impact with an estimated volume loss of 3.5 million units. Another 3 million units were impacted in 2022. (These losses are estimated from analyzing original equipment manufacturer announcements, compared to S&P Global Mobility's estimate of production planning volumes during the same time frames.)

During the first half of 2023, however, losses identifiable as specifically related to the semiconductor shortage fell to about 524,000 units globally. Although the supply of semiconductors remains constrained, more predictable availability has allowed automakers to adapt their production schedules.

As a result, we see semiconductors as a specific cause of production disruptions happening with less frequency.

Production in 2023 has improved as automakers and suppliers have adapted to the current environment, and 2023 sales are improving with more inventory. That said, the pre-pandemic momentum toward a 100-million global vehicle production year has been set back by a decade, according to S&P Global Mobility analysis.

So, where are we in mid-2023?

To level-set expectations, prior to the pandemic there always were semiconductor supply chain challenges一but they tended to be episodic, impacting a single component type or individual supplier. The semiconductor suppliers have customer service and production readiness teams working behind the scenes, and these resources have always managed these types of shortages with only rare interruptions in service.

What was unique about the pandemic period was the wholesale shortages among virtually all suppliers, impacting multiple component types (including microcontroller units一or MCUs一and analog based on mature process node capacity)."We've moved from obvious disruption, clearly visible at the automaker and plant level, to a stage where we know constraint remains, but it is impossible to identify," said Mark Fulthorpe, S&P Global Mobility executive director of global light-vehicle production. "We are now in a position where the auto industry has adapted to a constrained supply, and as a result is much less likely to be hit by significant disruption," Fulthorpe added. "With the current semiconductor supply levels, we estimate that 22 million units of global light-vehicle production per quarter could be supported."

However, industry demand for increasingly complex infotainment, advanced safety and vehicle autonomy systems will continue to escalate usage of semiconductors in vehicles. Phil Amsrud, senior principal analyst in the S&P Global Mobility supplier and components team, estimates that the value of semiconductors installed in vehicles averaged US$500 per car in 2020, but is forecast to reach US$1,400 per car by 2028. "Before the pandemic, the lead time from order to shipment of chips was three to four months. During the pandemic in 2021 and 2022, that wait grew to a year or longer," Amsrud said. " But while other industries - such as mobile phones and PCs一have experienced cooling demand of late, automotive semiconductor demand is increasing, and some chip manufacturers have pivoted capacity to address that need." That said, the types of chips for automotive-grade use versus communications equipment often are not the same; or there are different qualification levels in automotive that complicate using consumer grade components in automotive applications, Amsrud noted.

Chip shortage: it's starting to get better, but we still can't be relaxed

As an important application scenario of the chip, automotive chip in the chip industry from the vertically integrated mode (Integrated Design and Manufacture, IDM) to the vertical division of labor mode (for example, IP core enterprises, fabless design enterprises, foundry enterprises, professional packaging and testing enterprises) in the transformation process also shows a high degree of globalization characteristics. Extremely fine global division of labor is extremely unstable in the face of external shocks.

From the end of 2020, Ford, General Motors, Volkswagen, BMW, Fiat Chrysler, Honda, Toyota, Nissan, Volvo, Hyundai, Kia and other automobile manufacturers one after another due to the lack of supply of chips to reduce production, short-term shutdown or delayed delivery, the domestic automobile manufacturers, such as the Azure, announced that the production cuts, and even some of the automobile enterprises to launch the "core reduction version! "A large number of automobile enterprises have reflected in undisclosed channels that the price of chips has "skyrocketed" and "a core is hard to find". The market research organization British Esenhuamai company predicted that in 2021 the global automotive industry sales will be due to the "lack of core" reduced by 60 billion U.S. dollars. The shortage of automotive chips is the result of multiple factors such as changes in geopolitical patterns and external shocks to the market supply and demand imbalance, adjustments in the automotive industry's mode of operation, the uniqueness of the automotive chip industry itself, and changes in the industry's laws and regulations, and other multiple factors superimposed on the fermentation.

(A) the United States initiated a "trade war" and the new crown epidemic and other external shocks from the supply side of the impact of the automotive chip supply

U.S. suppression of China's high-tech field of "trade war" has disrupted the order of the global chip industry, coupled with the impact of global epidemics, natural disasters and other external shocks, the automotive chip supply in the short term fluctuations. The U.S. initiated to combat China's behavior destroys the global chip industry's production order stability expectations, triggering the global supply chain, especially the downstream enterprise decision-making big adjustment. The highly globalized characteristics of the chip industry determines the fluctuation of any one link will affect the stability of the whole industry chain, in the U.S. intervention led to the global chip industry order "chaos" in the context of global epidemics, the earthquake and fire in Japan, the Texas blizzard, the water shortage in China's Taiwan region, lack of electricity and power shortage of the earthquake, etc., the superposition of the local or global impact, in the context of the lack of supply of high-end chips. Insufficient supply of high-end chips under the background of the market triggered low-end chip "panic", and ultimately transmitted to the automobile manufacturers to form a serious problem of oversupply and underdemand.

(B) The crowding-out effect of consumer electronics and the incremental demand for automotive intelligence have led to rising market demand from the demand side.

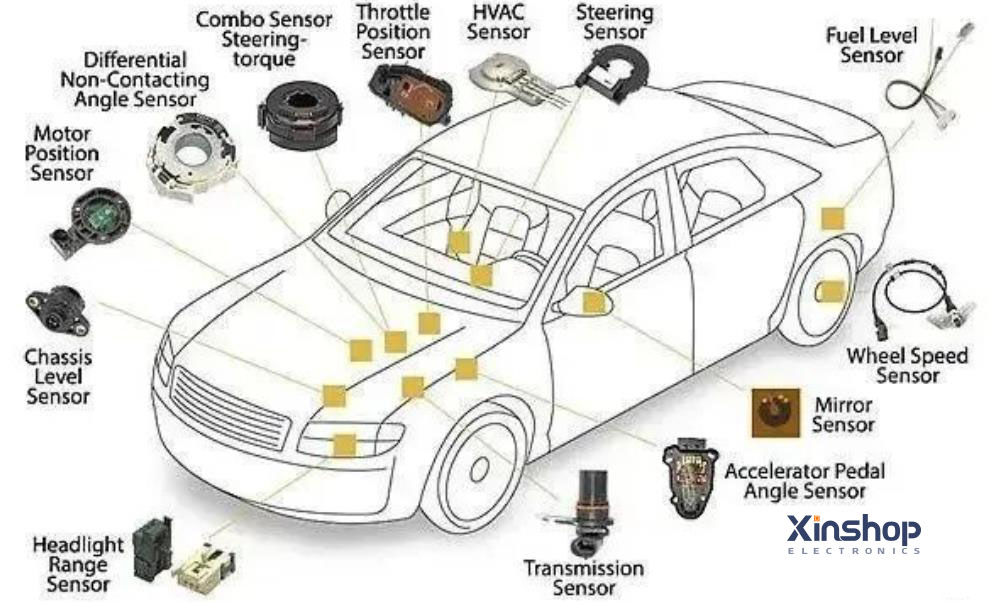

Demand side of the rapid growth of the consumer electronics market to form the automotive chip extrusion effect, the rapid growth of intelligent vehicles to form new demand and the automotive industry to accelerate the formation of the short-term demand expansion of stocking, the confluence of factors to lift the demand for automotive chips. The rapid development of electric vehicles, intelligent driving and other technologies and application scenarios continue to mature, the demand for single-vehicle chips has increased significantly, leading to the expansion of chip demand in the automotive industry. 5G, AI and other technology applications continue to mature, the demand for consumer electronics equipment, communications electronics chip surge, and its relatively high profit margins and higher shipments will motivate the chip manufacturing enterprises to allocate more production capacity to the consumer chip, forming a squeeze effect on the supply of automotive chips. and form a crowding-out effect on the supply of automotive chips.

(C) the automotive industry's operating model adjustment, especially the safety inventory model to promote the short-term demand surge

The automotive industry from the traditional focus on efficiency and cost of "zero inventory" to focus on industry chain resilience "safety stock" mode transition, forming a short-term rapid expansion of industry-wide chip demand. In the new crown epidemic and the U.S. "long arm jurisdiction" triggered by the "chip shortage" problem, Toyota as early as 2011 launched to protect the stability of the supply chain "business continuity program "Toyota was exempted from the chip shortage due to its Business Continuity Program (BCP) launched as early as 2011 to ensure supply chain stability, which had a huge demonstration effect on other automobile companies. Major automotive companies to increase chip stocking, and through consumers, distributors, vehicle manufacturers, suppliers, demand information transfer, resulting in a significant "bullwhip effect", the demand for chips continue to amplify, the formation of the market for automotive chips, a strong demand for automotive chip is expected, the whole industry chain inventory "reservoirs The inventory "reservoir" of the whole industrial chain forms a sharp expansion of the demand for automotive chips in the short term.

(D) The safety and stability needs of automotive chips determine the difficulty of new manufacturers to enter the procurement catalog and form an effective alternative

The uniqueness of the automotive chip itself determines the new chip manufacturer's products into the automotive manufacturer's procurement directory faces a higher risk and a longer period, further lengthening the automotive chip shortage cycle. In terms of engineering management of chip manufacturing, compared with consumer chips and general industrial chips, automotive-grade chips have more stringent requirements in terms of temperature, humidity, air pressure, error rate, usage time, etc., resulting in a long development cycle, high difficulty and high risk. At the same time, since it involves personal safety, it requires extremely high security and reliability. Therefore, the automobile manufacturers, especially the leading companies, in order to ensure the reliability and stability of product quality, the use of industry leading companies and mature suppliers is its "rational decision-making", new and late suppliers into the automotive manufacturers supply system is very difficult.

In addition, due to the automotive chip companies and automotive manufacturers to form a long-term stable "lock" relationship, upstream and downstream in the equity, business, social networks and other aspects of the formation of a relatively stable situation, which will greatly impede the market entry of latecomer automotive chip companies. In addition, as an industrial-grade automotive chip, compared with consumer-grade chips, there is also a significant difference is that the product update iteration cycle is relatively long, product reliability requirements are higher, which determines the automotive chip production process there is difficult to break through the tacit knowledge barriers. The combination of the above factors, with new products, suppliers and production capacity to achieve the existing supply shortage of "make up" there are significant technical and economic problems.

While the direct result of the chip shortage is to affect the production and sale of automobiles, the actions of governments and markets triggered by the chip shortage will have more far-reaching consequences.

First of all, the shortage will raise the price of automotive chips, which for the chip self-sufficiency rate of only 2.5% of China's automotive industry will cause greater cost pressure, further eroding the profit level of China's automobile manufacturing industry, and even directly affect the automotive industry's innovative development and catch up.

Secondly, under the atmosphere of automotive chip shortage, a large number of chip enterprises are expected to influx, there will be a "low-end chip surplus, high-end chip production capacity is insufficient" structural problems, and further aggravate the chip industry's cyclical investment fluctuations. According to enterprise search data show that only in 2020 and 2021, the newly established integrated circuit enterprises as high as 64,600 and 85,400, a large amount of capital influx into the chip industry, it is expected that some of these new enterprises in the future after the release of the production capacity will alleviate the problem of insufficient supply of automotive chips to a certain extent, and may cause the problem of excess supply of low-end chips. However, in the most short of MCU, SoC needs advanced process technology, high-voltage power devices required SiC, GaN wafers controlled by the U.S. and Japanese giants, coupled with the continued U.S. suppression, the short-term technology is completely independent of the difficulty is extremely high, so the high-end chip field may be the reality of the long-term supply of insufficient problems.

Thirdly, governments attach great importance to the shortage of automotive chips, through the strengthening of synergies between the automotive and chip industries in their own countries, to improve the localization of the industry chain, regionalization to enhance the resilience of the industry chain, "car + chip" will form a strong internal industrial alliance, which is in the beginning and catching up stage of China's chip and automotive industries This is a huge challenge for China's chip and automobile industries in the beginning and catching up stage, and it will be more difficult to use the opportunities of globalization to achieve late catching up in the future.

However, we need to see is that the global chip shortage will be solved in the next 1-2 years, but China's automotive chip supply, especially high-end chip supply of independent control will far exceed this judgment, is expected to be in the next 5-10 years, by cracking the key equipment, materials, EDA software, IP cores, manufacturing processes, such as "short boards "It is possible to form a leading ability in the chip field of the whole industry chain, in order to reduce the countries to reshape the industry chain on China's chip industry and the automotive industry.

4.Suggestions policy of Crack automotive chip shortage to protect industry chain security

The automotive chip shortage has been a significant challenge for the industry, impacting production and supply chains worldwide. To protect industry chain security and address this issue, here are some suggestions for policymakers:

Increase investment in semiconductor manufacturing: Governments can provide incentives and support for the expansion of semiconductor manufacturing capacity, both domestically and internationally. This can help alleviate the shortage in the long term by boosting chip production.

Foster collaboration between automakers and chip manufacturers: Policymakers can encourage closer collaboration between automotive companies and semiconductor manufacturers. This can involve facilitating partnerships, joint ventures, or long-term supply agreements to ensure a stable chip supply for the automotive industry.

Prioritize automotive chip production: Governments can work with chip manufacturers to prioritize the production of automotive chips. This could involve designating automotive chips as critical components and providing incentives to chip manufacturers to allocate more production capacity to automotive chips.

Enhance supply chain transparency: Policymakers can promote transparency within the supply chain by encouraging automakers and chip manufacturers to share information on chip demand, supply, and inventory levels. This can help identify potential bottlenecks and enable more effective planning and coordination.

Support research and development: Governments can invest in research and development efforts focused on developing alternative chip technologies or improving the efficiency of existing chip manufacturing processes. This can help reduce dependence on specific chip types and enhance overall chip production capacity.

5.How can Distributors help ease the auto chip shortage

Regarding the role of distributors in easing the auto chip shortage, they can contribute in the following ways:

Collaboration with automakers and chip manufacturers: Distributors can work closely with automakers and chip manufacturers to understand their specific chip requirements and supply chain challenges. By facilitating communication and coordination, distributors can help optimize the flow of chips within the industry.

Inventory management and allocation: Distributors can play a crucial role in managing chip inventories and ensuring efficient allocation. By closely monitoring chip availability and demand, distributors can help prioritize chip distribution to automakers and address any supply imbalances.

Diversification of supply sources: Distributors can explore alternative chip suppliers and diversify their supply sources. This can involve identifying new chip manufacturers or exploring options for sourcing chips from different regions to reduce reliance on a single supplier.

Risk mitigation strategies: Distributors can work with automakers and chip manufacturers to develop risk mitigation strategies. This can include measures such as buffer stock arrangements, supply chain contingency plans, or flexible sourcing arrangements to minimize the impact of future chip shortages.

6.Conclusion

To summarize the current situation of chip shortage in the automotive industry, the shortage has been primarily caused by a combination of factors, including increased demand for semiconductors from various industries, supply chain disruptions due to the COVID-19 pandemic, and the complexity of automotive chip production. The shortage has resulted in production cuts, delayed deliveries, and increased costs for automakers globally. Efforts are underway to address the shortage, but it remains a significant challenge that requires collaborative solutions from policymakers, automakers, chip manufacturers, and distributors to ensure the security of the industry chain.